Unbundling is an English term for breakdown or decoupling. In the business environment, it is a movement of market transformations. It happens through disruption of large conglomerates, with specific and more efficient offers.

Seeking to meet market pains

Historically, the cost and time required to produce and distribute solutions to customers in ways that satisfy them, hinder the viability of new products or services. To compensate, companies started to break down your value chain, with the breakdown of production assets, or the distribution of its business. In this way, they gain greater efficiency and cost competitiveness. This happened historically with the outsourcing (outsourcing) of several functions, for example, industrial production, distribution, service and call centers, generating new business opportunities.

With the internet and digital technologies, a second wave of breakdown. In it, some stagnant companies, with not so efficient solutions, began to see their businesses dismembered and attacked, in part, by smaller companies specialized in solving specific problems.

How did the Unbundling movement come about?

The unbundling movement is led by entrepreneurs with a deep desire and mission to better serve the customer. Therefore, they develop solutions in an agile way to offer a higher quality product and service, as well as, experience or value than the limited offer of the current incumbent.

We can observe that, until the turn of the century, printed newspapers were aggregators of stories, articles, restaurant guides, classified ads, etc. Thereby, Google dismembered the articles section, offering a search site for whatever you wanted to read. Yelp did the same with restaurant suggestions, and Craiglist with classified ads.

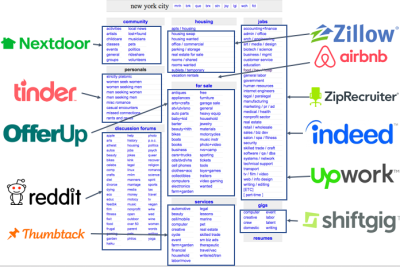

Likewise, after a few years, the same Craigslist began to suffer an attack from several other small players in the most different verticals of its performance.

Some examples of Unbundling

The classic illustration represents very well how Craigslist attack and unbundling occurred by several insurgents:

In the financial market, the unbundling it also happens, generating the breakdown of large banks into small offers by fintechs, as a similar illustration:

Competitive Analysis: how to find space in populated markets?

In Brazil, with a bank oligopoly, the environment becomes "favorable" for unbundling. Here, a classic and much discussed case was the dismemberment in the area of means of payments and "machine war". The study ACE Cortex and Boost.lab showed the breakdown of that market.

Rebundling

In the same way where, in disrupting markets, massive attacks by small new businesses, many of them do not survive due to several factors. Some of them are: competition with each other, traction, low network effect, low investment, solution or business models that don't work, among other factors.

With that, the next moment is for consolidation.

Consolidating the market

Some disruption winners begin to have relevance within markets. Leveraged by customer trust and data, these companies are able to bring better experiences from new offers. This expansion happens one by one, in a movement of reassembly and consolidation. Usually, horizontal shape us, combining complementary services such as forums, content, additional services, for the same client.

This reorganization of the markets, in general, is capable of bringing a greater catch for these companies. Smaller categories of services, such as the Craigslist breakdown, are capable of generating companies of great value, such as Linkedin and AirBnB.

The map below shows, for example, some winning service marketplace platforms within the Craiglist breakdown, as seen on the previous map:

The same reorganization has been happening with the financial market. Some of the most successful fintechs in recent years have already started to develop solutions and move forward within their value chain. In this way, they are able to fully meet the needs of their customers.

Understanding the valuation of large companies

Other examples of unbundling and rebundling in the Brazilian financial market were:

- Pagseguro: it started as an online payment solution and added other payment services, and in the last two years, it became a bank with current account offers, credits etc ...

- XP: it disaggregated the investment market for individuals in Brazil, launched a bank and, more recently, credit cards.

- Nubank: attacked the pain of high fees and bad services in the credit card market, and in the following years coupled current accounts and credits for its customers.

- Linx: traditional management software company for the retail market, has developed Linx Pay in the last few years, a service of acquisition as a service connected to its traditional offer.

Focus on solving specific pains

As a manager of a large company or entrepreneur, you must always improve your products and services, and be aware if the way to solve your business is the best. Like Pedro Waengertner says in your book - “Kill your own business”, before someone else does.

For entrepreneurs who are thinking about building new solutions, the best way is to break up markets and build products focused on solving specific pains, which are large and recurring, and which are being poorly served, before trying to embrace the entire market with a broad solution.

How to create business in an innovative way?