The crisis has increased the perception of startups as a fastest innovation tool by companies, mainly for 4 reasons:

- Scanning, co-creation and go-to-market of new products and services through startups

- Acquisition of talents and solutions and technologies with greater integration and less risk of failure

- Proximity market trends, new technologies and business models

- Growth new revenue lines via investments and mergers and acquisitions (M&A)

Why innovate with Startups?

Innovating with startups has become an instrument widely used by companies in the international market, in addition to gaining a lot of support. As different market data show: 75 out of 100 Fortune companies have specific actions and structures to approach startups, in 2019 more than 3,000 investments were made by corporations in startups (CrunchBase and CBInsights) and 90% of unicorns Chinese (companies valued at more than 1 billion) have at least one corporate investor (GCV Analytics).

We are living the fifth wave of Corporate Venture Capital (HSM), with a very striking characteristic and different from the previous waves. Companies live in a constantly evolving, globalized and fierce market, and corporations are looking for higher LTVs (greater customer lifetime value) that can pay higher CAC (customer acquisition costs). In addition, they seek better monetization to obtain a competitive advantage for growth (Corporate Venturing: A Survival Guide).

In Brazil the scenario is different. Most initiatives are less than 2 years old (ACE and Fisher Venture Builder), and in the coming years we will have more companies with corporate venturing programs, actively participating in investments and acquisitions of startups.

What are the tools that companies have to innovate with startups?

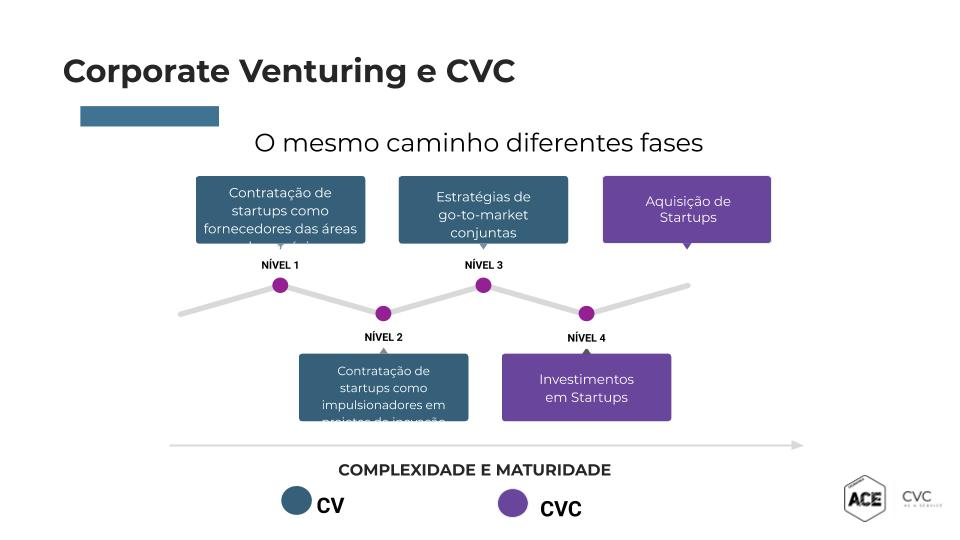

Inside Corporate Venturing there are two large groups that are not disconnected from each other but rather have a different characteristic:

We can divide it into 2 groups:

- Relationship actions with startups that do not need direct investment.

- Relationship actions that need direct investment in startups. Also called Corporate Venture Capital.

The following table shows the different possibilities with and without direct investment in startups.

The companies, for having a wide range of possibilities in relating to startups, and being a relatively new market, end up getting lost and applying measures beyond maturity or taking actions that are not aligned with the company's strategic objective. As the results of our research with 140 corporate programs show, every 5, 4 relationship programs with startups end up not reaching their goal.

How to begin?

We need to answer some questions: What stage of relationship with startups should the company work for? How to set the right goals? How to measure the impact on the relationship with startups? are frequently asked questions. For me the relationship between companies and startups is like a coach with an athlete.

Working with Corporate Venturing is similar to the person who wants to run a marathon. In addition to being passionate about innovation, working with startups since 2008 I am a PhD in Physical Education and I have been 9 times champion of Spain in wrestling for what I have trained with many fighters in different countries and also years ago with people who wanted to start in physical activity.

When someone comments that they want to run a marathon, the first question I ask is: Congratulations on the initiative but ... how many times do you train a week? Have you ever run such a long distance? Did you do a physical evaluation? Depending on the answer, which most of the time is not for all, I answer: "Well… let's start with the basics, know your physical condition and start putting on short frequent training".

The importance of preparing

If we don't, you will definitely run a marathon with a high chance of getting injured, and the race will not end. In the worst case, you will get frustrated and your motivation will drop, thinking that this type of activity is not for you ".

Once physical condition is measured, knowing the stage the person is in and setting small goals, we will evaluate until we have better running times and fitness. This will tell us that we are going the right way, and before doing a full marathon, we will do a half marathon to see if the person is really ready. Only after all this, will you be able to achieve your final goal.

Certainly, once this whole process has been successfully completed, taking into account the characteristics of each stage, the person will be able to successfully complete their goal, with health and ready for greater challenges with results and motivation high above.

Preparation for Corporate Venturing

Companies that want to innovate with startups, through corporate venturing, have a similar process. First, the company must know what stage it is at, how it will measure success in financial terms, and most importantly: how it will impact the company's strategy. Corporate venturing studies (book Master of Corporate venture Capital) show the importance of measuring the impact on the strategy, and its importance for the survival of corporate venturing within the company.

In addition to setting goals and knowing how to measure them, it is important to know that hire a qualified person. In the book Corporate Venturing: A Survival Guide, which studies different corporate venturing, the importance of having a qualified team to be successful in the project is shown. It is essential to have people with specific knowledge in startups, who speak both languages, corporation and startups, and know how to move through these two "worlds". Another interesting data following the J. Thelander Consulting Corporate Venturing professionals, at least 50% comes from outside the company, including consultancies with experience in Corporate Venturing

Companies can move forward in different stages of relationships with startups or even workers at the same time.

Summing up, companies can innovate strategically with startups according to their maturity. It is important to know which, or which stages to start with, before measuring financially and strategically the impact caused to the company. In addition, it is essential to set goals and measure everything, to know when the company will be ready for new challenges, and to show results at home.

Corporate Venture Capital: how to create a successful strategy?

Corporate Venture Capital: what is it and what are the benefits?